The cannabis retail landscape grows more competitive each year, with dispensaries eager to roll out rewards programs to attract and retain customers. These programs promise higher customer loyalty and bigger basket sizes, but what does it really cost to keep them running? More importantly, do the returns justify the investment?

Unpacking the Costs of Loyalty Programs

Dispensary owners often underestimate the true costs, focusing only on the value of rewards redeemed by customers. However, the reality includes multiple hidden expenses that quickly add up:

- Technology Investments: Rewards software integrated into a dispensary’s POS system often runs $200 to $1,000 per month. Platforms offering features like mobile apps, text marketing, or tiered rewards programs sit at the higher end of that spectrum.

- Marketing Efforts: Crafting promotional materials, updating digital channels, and sending texts or emails about new rewards require consistent spending—sometimes thousands of dollars monthly.

- Staff Training and Labor: Employees spend extra time enrolling customers, helping with app issues, or processing redemptions. Just five minutes per transaction becomes significant when multiplied by hundreds of customers every week.

- Compliance Costs: Legal reviews to ensure rewards programs follow state and local advertising restrictions are crucial. Fees for these legal services easily reach $1,000 to $5,000 annually, adding another layer of cost.

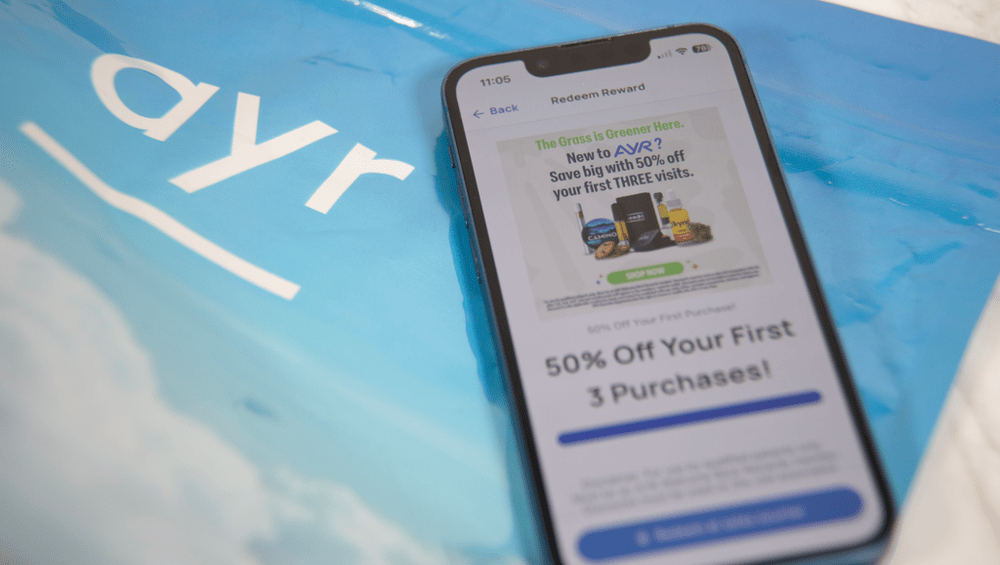

- Discount Expenses: The most obvious cost is lost revenue from discounts. For example, offering a $10 preroll for every $100 spent effectively provides a 10% discount on sales—eroding already thin profit margins in a high-tax industry.

Small-to-mid-sized dispensaries often find themselves spending between $5,000 and $10,000 per month once all these factors are included.

Understanding ROI for Rewards Programs

Well-executed rewards programs can deliver impressive returns. Loyalty members spend 35–50% more per visit compared to non-members, according to retail analytics firm Headset. That kind of lift becomes crucial in competitive markets where price wars make customer retention essential.

Several key factors determine whether the rewards program’s ROI justifies the investment:

- Retention Improvement: Programs must increase repeat visits to offset costs. Successful strategies often raise retention rates by 20% or more, translating into consistent monthly revenue streams.

- Order Size Growth: Customers encouraged to reach reward tiers usually spend more. Even modest AOV (average order value) increases of 10% can tip a program into profitability.

- Reducing Churn: Strong loyalty programs build emotional ties, transforming occasional shoppers into regulars who form the backbone of dispensary revenue.

- Leveraging Data: Loyalty platforms provide insights into customer behavior, enabling smarter inventory decisions and targeted marketing campaigns. Acting on these insights turns raw data into a competitive advantage.

Summary

Rewards program costs extend far beyond redeemed points. Technology, labor, marketing, compliance, and revenue lost through discounts together form a substantial monthly expense. Dispensaries that manage these programs strategically often enjoy higher visit frequency, larger average purchases, and deeper customer loyalty—more than covering costs.

Without thoughtful design and consistent measurement, a rewards program risks becoming an expensive liability, draining margins rather than enhancing profitability. Regular reviews of actual redemption costs and performance data allow dispensary owners to adapt programs quickly. Such proactive management ensures loyalty initiatives remain a worthwhile investment instead of a costly marketing misstep.